When pricing new public housing flats, should the government rely on the historical cost of land as a benchmark or its current market value?

Put another way, should you, as a home buyer, pay a price based on the actual cost of land to the government—a transaction which may have occurred decades ago—or should you pay an amount based on the land’s current value today? What is the key purpose of subsidised housing: an affordable place to live or an investment to make gains?

Despite Singapore having run its public housing program since the 1960s, such fundamental questions lack a clear answer. Using market values to determine pricing for new flats, as has been the case since inception, is an increasingly unaffordable approach given rising property values.

The time has clearly come to engage in an open debate on this very basic issue that has widespread policy implications.

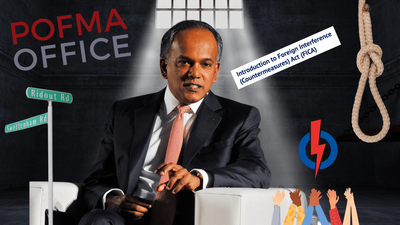

Yet when Yeoh Lam Keong, a former chief economist at GIC, a Singapore sovereign wealth fund, dared to suggest an alternative, the government slapped him with an order under the Protection from Online Falsehoods and Manipulation Act (POFMA), a law meant to counter lies and disinformation. By doing so, it has shown that it would rather mouth platitudes than engage in rigorous debate.

It began when Desmond Lee, the minister for national development, told Parliament that the Housing Development Board (HDB) would incur a S$270m loss on a new build-to-order (BTO) project in Ang Mo Kio (AMK).

On Facebook, Yeoh responded that the apparent losses made by the government in selling subsidised BTO flats were more of an “accounting sleight of hand” or “opportunity cost” loss as the original purchase cost of the land used for construction of BTO flats was very low.

In its POFMA order, the Ministry of National Development (MND) offered the “correct facts”, the essence of which is that one should use the current market value of the land and not historical cost to calculate profit or loss and that there are strict protocols the government needs to follow when dealing with state land.

Who is right? Let us look at both arguments. A good starting point would be the Land Acquisition Act of 1966, which empowered the government to acquire private land compulsorily, helping it become by far the biggest landlord in the country, owning some 80 percent of land today. As Singapore’s economy grew (at double digit rates for many years) so did land prices, creating massive gains for the government.

All the land buying in the 60s was effectively a shrewd investment by the Singapore government, hugely benefiting the reserves. It’s similar to what Li Ka Shing and other tycoons did in Hong Kong when they bought land at rock bottom prices during the chaos of Mao Zedong’s cultural revolution in the late 60s and early 70s.

It is thus intuitive to assume that whenever the government sells land, it must be making huge profits. This is Yeoh’s central argument. The original cost of the AMK BTO project would be so low (imagine land prices in the 60s) that the profits to the government would be massive even after including today’s construction costs.

The government however sees it differently. It says that the estimated land cost for the AMK project should not be the historical cost but its current market value of S$500m as estimated by the chief valuer. HDB has to pay fair market value to past reserves to purchase the land.

When that happens, one might assume that the past reserves should increase. But the government says it doesn’t.

Why not? What has happened is that the land bank in the past reserves is constantly getting revalued—or in financial parlance “marked to market”. As land prices rise, so does the paper value of the government’s land bank. When the time comes for a sale, the cost of the marked-to-market land and the money received from HDB cancel each other out, meaning the past reserves show no change.

It’s not that different to a property investor partially cashing out by selling one of their properties from the portfolio. The overall portfolio value remains the same—it’s just that the cash balance has gone up as the property holding has gone down.

So, Singapore’s past reserves might not benefit from one specific transaction such as the AMK project but they undoubtedly have benefitted through the years.

Clearly, there are no “facts” here that have been distorted, only different interpretations. Lee was focusing purely on HDB’s loss based on the land’s current value. Yeoh argues that we should consider the profits that the entire government has earned through its land ownership over the decades—and question whether this approach still fulfills “HDB’s original mandate of affordable housing for all.”

So, are BTO flats overpriced because of government profiteering?

Not if one compares it to the vibrant resale market where old HDB flats still get transacted at a strong premium (this creates its own problems which are beyond the scope of this article).

Yeoh’s suggestion of pricing BTO flats based on construction costs and a premium will work only if major changes are made to the structure and functioning of the current HDB resale market. He suggests that “a longer minimum occupation period (MOP) can be used to protect the market value of resale flats.” Any such change however will need to be considered carefully as it will have a significant impact on the entire property asset class in Singapore.

If Yeoh’s suggestion is adopted, the next generation of HDB flat owners will pay a lower price than previous ones. Is that fair? What will be the impact on Singapore’s reserves and investment returns? These are some of the important questions that deserve a fair hearing.

What would have helped is for the MND to acknowledge the different possible interpretations in land pricing and openly discuss the pros and cons of various proposals. After all, MND said that it can sell land at lower prices with the president’s approval—so it is possible.

The onus is on the government to clearly explain its fundamental principles behind subsidised housing. After all, this is what a consultative and transparent 4G government is all about, right?

An unnecessary POFMA diktat that prematurely terminates debate helps no one.

Bobby Jayaraman is an investment professional. He was previously a consultant with McKinsey & Company. He is the author of Building Wealth Through REITs.

If you enjoy Jom’s work, do get a paid subscription today to support independent journalism in Singapore.